Let’s take a closer look at the world of Crypto while going through the happenings of this year’s market movements. From seismic shifts in Bitcoin’s trajectory to the strategic maneuvers of major players like BlackRock and the intriguing rise of meme coins, we’ll explore the diverse landscape of crypto

Join us as we delve into the headlines, deciphering their potential implications for the week ahead.

- Concerns over Juno's Custody: Users Advised to Withdraw Amid Partner Uncertainty, Impacting Crypto Assets

- Vietnam's Crypto Surge: 16.6 Million Holders Spearhead Global Adoption, Led by Bitcoin (Report)

- Bitcointry Integrates Shibarium, Potentially Fueling SHIB and BONE Rally

- Ethereum's Continued Smart Contract Supremacy Amid Solana's Emergence: Insights from Coinbase and Market Projections

- Bitcoin's Evolution: From Portfolio Diversification to an Imperative Reserve Asset for National Treasuries - Insights by Franklin Templeton

- BlackRock Bows to SEC, Adopts Cash Redemption for Bitcoin ETF in Regulatory Compromise

Juno’s cautionary advisory to users regarding custody issues with its partner highlights the precarious nature of entrusting assets on third-party platforms in the crypto space. The call for users to withdraw and opt for self-custody or fiat conversion amid uncertainty underscores the vulnerability users face in centralized systems. This incident, resulting in a significant decline in stored crypto assets and the platform’s native token value, emphasizes the inherent risks associated with reliance on custodial entities and their potential impact on both platform stability and asset valuations.

Vietnam's Crypto Boom: 16.6M Holders Drive Adoption, Favored by Bitcoin

Vietnam’s burgeoning crypto landscape, with 16.6 million holders constituting 17% of the population, positions the country at the forefront of global cryptocurrency adoption. Bitcoin stands as the preferred asset among Vietnamese investors, comprising a significant portion of their digital holdings. Notably, Vietnam’s leadership in crypto adoption, recognized by Chainalysis, underscores the nation’s fervent interest in blockchain-based ventures, particularly evident through the prevalence of GameFi, NFTs, and Web3 projects, cementing its status as a key player in the evolving crypto space.

Bitcointry's Shibarium Integration Sparks Optimism

Bitcointry’s integration of Shibarium onto its platform signifies a significant stride in expanding the utility and accessibility of Shiba Inu’s ecosystem. This move not only amplifies Shibarium’s reach but also fuels optimism within the community for potential rallies in assets like SHIB or BONE. Shibarium, launched to enhance Shiba Inu’s performance by reducing transaction fees and improving transaction speed, has achieved impressive milestones, surpassing one million blocks and nearing 3.5 million transactions, highlighting its growth and adoption within a relatively short period.

Ethereum vs. Solana: Market Dynamics and Future Projections

A recent report underscores Ethereum’s enduring dominance in the smart contract realm despite the emergence of competitive networks like Solana. This affirmation of Ethereum’s leading position, backed by its share of the crypto ecosystem and impending upgrades, signals stability in the market. However, Solana’s rapid rise, propelled by its superior transaction speeds and growing DeFi ecosystem, hints at a potential shift in dynamics, fostering diversification and competition within the cryptocurrency landscape.

Bitcoin's Future: Portfolio & Treasury Revolution

Sandy Kaul, from Franklin Templeton, advocates for a transformative future where Bitcoin becomes a cornerstone in both investor portfolios and national treasuries. Emphasizing its potential to level the economic playing field for developing nations and streamline cross-border transactions, Kaul suggests Bitcoin could evolve into a crucial reserve asset for every country. This bold assertion, coupled with Franklin Templeton’s pursuit of a Bitcoin ETF, signals a growing institutional acceptance that could significantly impact traditional portfolios and global financial strategies, potentially reshaping the landscape of both investment diversification and cross-border currency exchanges.

BlackRock's Bitcoin ETF: SEC Compromise and Adoption of Cash Redemption

BlackRock’s revised Bitcoin ETF filing, opting for a cash redemption model, reflects the asset manager’s concessions to SEC regulations, delaying the in-kind creation process tied to Bitcoin. This adjustment, aligned with similar shifts by rival ETF applicants, showcases an industry-wide adaptation to SEC preferences, albeit at the expense of potentially tax-efficient and streamlined in-kind redemptions. While this move signifies compliance efforts with regulatory concerns, the delay in adopting the in-kind model could impact market expectations for the launch of more tax-efficient Bitcoin-based ETFs, potentially influencing investor sentiment regarding the future of cryptocurrency ETFs.

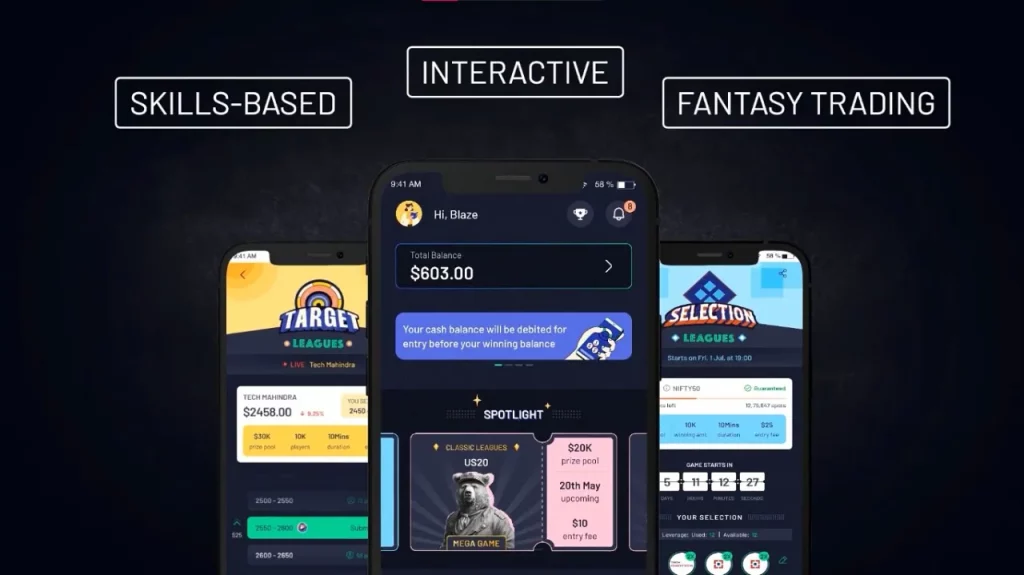

The Perfect Time to Set your Sights on TradingLeagues

In a crypto world brimming with uncertainty and rapid evolution, finding a stable ground for learning and honing trading skills can make a huge difference. Amidst this turbulence, TradingLeagues, the fantasy crypto trading app emerges—a platform offering a secure and guided environment to compete and learn about the intricate world of trading.

As the crypto landscape remains fraught with risks and volatility, TradingLeagues provides a haven—a place where enthusiasts can improve their skills in the art of effective trading strategies without being entangled in the hazards that often characterize the crypto space. TradingLeagues is truly a space where competition meets education, allowing individuals to navigate and understand the nuances of trading without falling victim to the rapid-changing nature of the trading market; be it stock or crypto.

Conclusion

In this year’s crypto market, we’ve witnessed a rollercoaster ride of events that paint a diverse picture of the industry’s evolution. Juno’s custody crisis served as a stark reminder of the risks associated with centralized platforms, urging users to rethink reliance on third-party custodians. On the other hand, Vietnam’s meteoric rise in crypto adoption signifies a global shift, with 16.6 million holders amplifying the country’s role as a key player in the crypto landscape.

Bitcointry’s integration of Shibarium sparks enthusiasm, showcasing the potential for a rally in assets like SHIB or BONE. This development speaks volumes about the expanding reach of Shiba Inu’s ecosystem. Ethereum’s continued dominance, as highlighted amidst Solana’s emergence, hints at stability but also a changing landscape of competition and diversification.

Moreover, Sandy Kaul’s foresight at Franklin Templeton indicates a transformative future where Bitcoin becomes not just an investment asset but a cornerstone for national treasuries, promising economic parity and streamlined transactions. However, BlackRock’s compromise with the SEC, while addressing regulatory concerns, introduces uncertainties about the timeline and nature of future Bitcoin ETFs.

As we look forward, these developments foreshadow a crypto market grappling with regulatory adaptation, institutional integration, and the ongoing tug-of-war between established and emerging networks. The volatility, innovation, and regulatory navigation will continue to shape the crypto landscape, offering both opportunities and challenges for investors, enthusiasts, and the market at large.