Being a new day trader can feel overwhelming. You look at several charts and analyze numerous indicators, but you’re left more confused than when you began your research. You build up your confidence and make a few trades, but they don’t work out as expected.

Don’t worry. This is very prevalent among day traders who are just starting. The important thing is to be focused and keep learning -especially from your mistakes.

Here are the basics of day trading and a few common errors that you should learn how to avoid.

Day trading refers to trading activity in which a trader opens positions in financial instruments (such as stocks, commodities, currencies, etc.) and closes them within the same day.

The goal of day trading is to make a profit from short-term price fluctuations. Day traders usually rely on technical analysis to assess price trends and patterns and make their trades.

If a trader does not close an open position on the same trading day, they may need to pay an additional fee (known as a swap fee or overnight fee) to the broker.

Day trading is also commonly referred to as intraday trading.

Is day trading the most profitable form of trading?

There are several ways to trade in the financial markets. Some examples include swing trading, position trading, and momentum trading.

Day trading has a lot of possibilities and it requires focus and discipline throughout market hours.

In contrast, swing trading involves making a few trades over weeks, hence it may require less time commitment.

Further, positional trading takes place over a few weeks to a few months. The focus is on longer-term investment horizons.

The type of trading that you choose should depend on your personal goals, risk tolerance, trading style, and level of commitment.

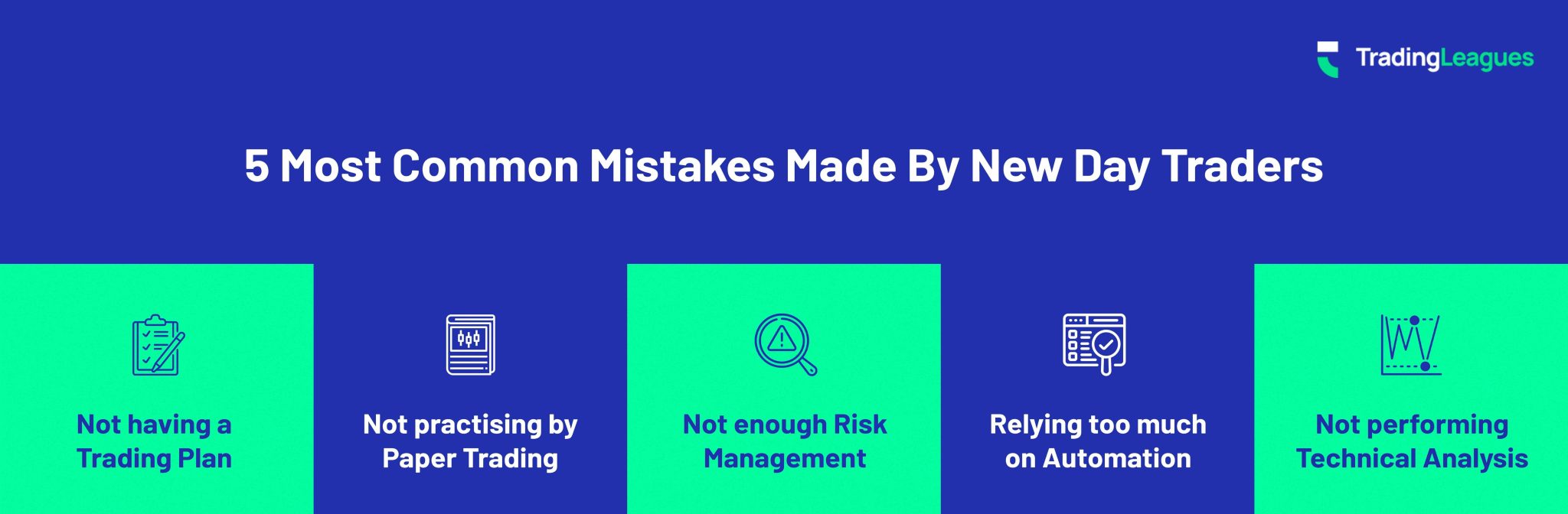

5 most common mistakes made by new day traders

Here are some mistakes that experienced traders will tell you to avoid:

-

Not having a trading plan

A trading plan is essentially a way for you to outline your trading goals, approach your trading strategies, and your risk management techniques.

A trading plan will help you be disciplined as a trader, keep your emotions at the door, and make consistent trading decisions that compound over time. Your trading plan also needs to consist of a trading journal, in which you record your trades, so that you can learn from them.

As you learn more and more about trading being a trader, you can keep updating your trading plan so that it evolves with you.

-

Not practising by paper trading

Paper trading essentially means trading for practise without using real money.

Several brokers offer free demo accounts or paper trading accounts through which you can practise your trading skills. Once you formulate your trading plan, the next step is to try out your trading plan by paper trading.

The primary advantage of paper trading is that you can practise under real-world conditions. Paper trading will help you gain insight into how the financial markets work, and find out which strategies are working for you and which are not. It will also help you understand technical indicators, how to use risk management techniques, and which instruments to focus on.

-

Not enough risk management

Risk is a part of trading. Every trader needs to learn how to minimize risk and maximize profit. Luckily, there are tried and tested risk management techniques that can help you.

The most basic techniques that you need to know about are using stop-loss orders, managing leverage (also called margin), managing order sizes, managing the frequency of trading, and understanding risk-reward ratios.

A great way to manage risk as a trader is through diversification. Do not enter into multiple positions which are all based on the same trend. For example, traders can hedge their bets by trading in gold on one side and in USD on the other, since they have an inverse relationship.

-

Relying too much on automation

Many trading platforms these days have built-in automation or algorithmic trading tools (including the highly popular MetaTrader).

While such tools have their advantages (such as faster execution of trades and removing human emotions as a factor), there are some disadvantages as well.

Software tools lack human judgment and can only act according to certain pre-programmed rules. This can easily lead to over-selling, over-buying, or the wrong timing of trades.

-

Not Performing Technical Analysis

To become a trader to be reckoned with, beginners need to start learning about technical analysis and how to use such strategies to their advantage. Technical analysis is essentially using previous price data and patterns to predict future price movements.

There are a lot of sources through which one can learn about technical analysis such as books, courses, and even YouTube.

How to become a successful day trader?

There are no secrets to becoming successful at trading.

To become a successful trader, you need to put in the hours required to learn the craft. Traders need to practise trading as much as they can and keep abreast with financial news.

Take small steps in your trading journey. For example, pick and study one asset class rather than overwhelming yourself with all of them. You can focus on large-cap stocks or precious metals like gold and silver or others.

Day trading rules for beginners

- Set aside time each day to learn and practise.

- Be realistic about profits.

- Keep a strict trading budget.

- Don’t become over-confident after making a profit.

- Don’t use too much leverage (also called margin), especially when you’re a new trader.

- Try to make peace with any losses.

- Keep a constant eye on relevant technical indicators.

Why do new day traders need to practise?

Trading is a skill like any other, and practise is essential to get better at a skill. You cannot learn trading just through books or videos. You need to get your hands dirty and start practicing.

Luckily, there are ways in which you can practise without any stress and without risking your money, such as through TradingLeagues. TradingLeagues is a fantasy stock market game app to help stock market traders practise trading through fun and engaging games.

There are various games to choose from such as Battle Leagues, Classic Leagues, Selection Leagues, and Target Leagues. Each type of game helps you learn about a different aspect of trading.

Wrapping up

Day trading can be a rewarding experience. It is important to not be a lone wolf and take help and learn from others on your trading journey. Join TradingLeagues to see where you stand amongst other real traders. We wish you the best.