For stock market enthusiasts, intraday trading is one quick way to earn some profit. Dabbling in the stock market already has several risks associated with the practice. You need to improve your trading skills to minimise the chances of making losses in stock trading.

When buying or selling shares, it is important to take advantage of any price movements. This is important since intraday trading is related to buying and selling financial instruments on a daily basis. It is important to square off your position before the stock market hours end. This means that you can leave any overbought or any oversold position open at the intraday trade time end. Such trading is all about quick and short-term gains.

While dealing with regular stocks in the market also has associated risks, intraday trading risks are much higher. As a beginner interested in intraday trading, you must be aware of the high volatility involved in the stock market. The thumb rule for intraday trade is not to risk more than 1-2 per cent of the overall trading capital on one single trade.

7 essential tips to improve intraday trading skills

While you can gradually gain expertise about the best ways to deal in stocks, intraday trading needs some understanding at the outset. Here are some essential tips that will help improve your intraday trading skills.

1. Have a proper intraday strategy

Develop a strategy for intraday trading and stick to the same. The top kinds of strategies for intraday trading are mentioned below.

Momentum strategy

For an intraday trade to bring in profit, you will need to track slight price changes in stocks. Keep a list of stocks ready that you will monitor around the day. As soon as the price changes and goes slightly, you invest in the same. The next step for intraday trading to work is to sell the same stock at a much higher rate.

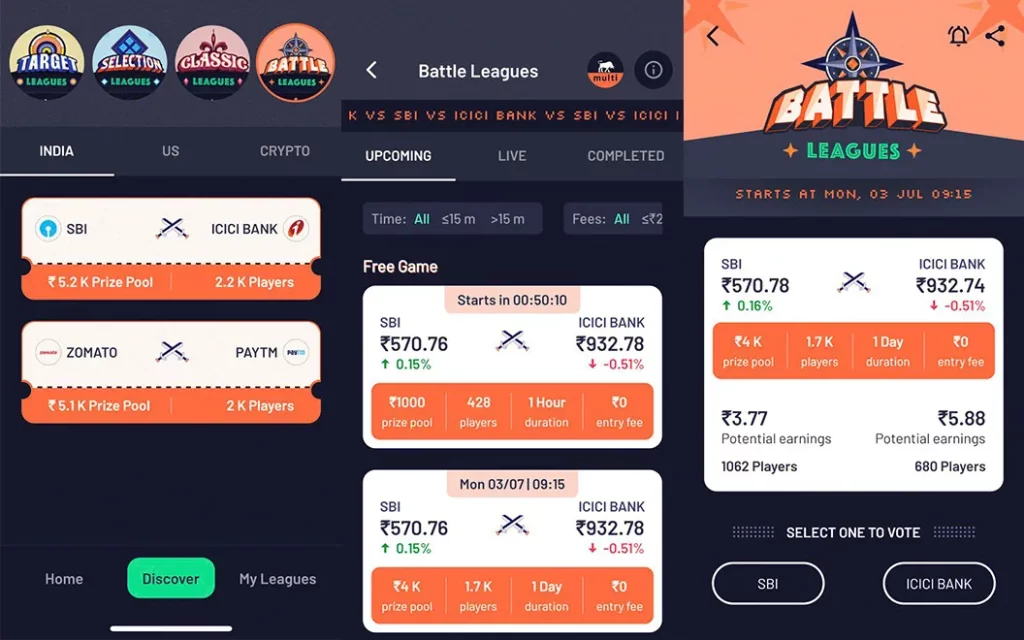

The idea to make this strategy work is observing the stocks for a consistent period of time. If the price sees an upward rise for a period of time, you can buy the same and sell off later. TradingLeagues has an interesting gaming option called Battle Leagues. It helps you practise stock price predictions. This might help you become better at acing the momentum strategy.

Breakout strategy

When you buy or sell shares on a single day, one strategy is to look for stocks that seem stable or unable to move above or beyond a certain price point. As a stock market amateur, you must aim to break out in a direction the stock might move on to.

Once the price moves beyond the resistance level, you can make a profit. Watch out for price trends and stock performances regularly to identify what stocks are fit for using a breakout strategy on. The timing is also equally important.

Reversal strategy

There is a much higher risk attached to this strategy than with risks involved in the others. With a reversal strategy, you need to monitor the price fluctuation of a stock. You can pick a stock expecting it to go against its usual price trend.

When the stock price trends reach an ultimate low or high, it could perform in reverse. You can make some profit according to this reverse mechanism for stock price performance.

Scalping strategy

With the scalping strategy, you make financial profits from very small changes in price. The strategy is used when you engage in high-frequency trade. The idea is to trade quickly, in succession, instead of waiting for a big trade move. It is akin to trading in higher volume for a low-priced share when the market is on the upward slope for the share.

Moving average crossover strategy

Here, you need to track the price movements as they reach a high or low to decide on stock momentum changes on an average basis. The average value holds for a specific time frame. You do not need to account for daily or frequent price fluctuations. Depending on the uptrend or downtrend in the average figure, you may buy or sell stocks during the day.

Gap and go strategy

Often thought of as the most dependable intraday strategy. This involves looking out for stocks and their pre-market positions and volumes. Using stock scanners is helpful in this context. Traders can engage in buying or sell-offs when a gap signifies an upward or downward trend.

2. Build an effective intraday watchlist

Developing an intraday watchlist is important before you engage in intraday trading. For this, identify stocks that sync with strategies you use for trading. While building an effective watchlist takes time and research, it gives you an edge in trading. A watchlist should comprise stocks that you need to follow regularly. Building it needs some understanding of the following factors-

- Market-related awareness

- Capitalization level and its impact on stock pricing

- News catalysts and their influence on stock movement

- Stock seasons and economic scenarios

Here is the TradingLeagues stock watch list that helps you monitor trending stocks filtered out according to their respective markets.

3. Choose the right trading platform

Several trading platforms offer beginners and experts the scope to trade in stocks. The main differentiators among these platforms are variations in brokerage charges and the ease of use.

TradingLeagues is one such platform that helps users understand how stocks behave by practising the games available. The app has numerous games focused on stocks that make users better tackle the market while they get versed in the dos and don’ts.

Take a look at the best trading apps in India here.

4. Intraday time analysis

The timing of intraday trading is important. The earliest period for trade in the mornings can be more volatile than, say, an afternoon slot for trading. There are intraday time trading charts that help traders understand the price fluctuations around the day. The charts are relevant to short-term, medium-range, and even long-term. Most intraday traders follow short-term charts such as-

- 2-minute charts

- 5-minute charts

- 15-minutes chart

- 1-hour chart

Read further to understand Intraday time analysis here.

5. Understand how risk management tools and indicators work

Risk management is key to making a profit from intraday trading. The amount of risk varies as per your stock choices, asset performance, market fluctuations, catalysts, watchlists, and so much more. However, the best way to make profits from day trading is to understand how trade indicators work.

Stock markets and trading are not entirely free from risks. When you begin to pick the right stocks, invest the least amount and diversify your intraday trade portfolio, you minimise such risks. Intraday trading indicators signify specific parameters that help traders understand market trends, volatility, and the best breakout opportunities.

6. Don’t move against the market

There is a reason why the best stock traders follow market trends. As an intraday trader, trying to outsmart the market could bring in losses. Especially as a beginner, it is suggested that you keep track of market trends, pricing, and volatility before riding on the wave. Besides such basics, it is important to research news catalysts, charts, and breakouts before indulging in day trading. Develop an understanding of the way the trends work on stock prices. Use multiple strategies to choose the right mix of stocks. Making an informed choice instead of a whimsical gamble always helps.

7. Engage in stock market games

Practice makes you perfect at any skill. Well, almost perfect. Try playing innovative stock market games to understand the basics of the market. With that being said, by playing stock market games, you can get introduced to the financial markets in a fully immersive manner without the hassles of maintaining a brokerage account.

TradingLeagues is one such app that offers a gamified introduction to the markets for a beginner. You can learn with every contest, from picking the right stocks to understanding technical analysis. These stock market games break everything down simply.

Engage in stock market games across the four distinct leagues on the app-

- Battle Leagues – As a virtual trader, on Battle Leagues, pick stocks, watch them go up or down, research the price trends and finally, understand what factors dictate the stock behaviour.

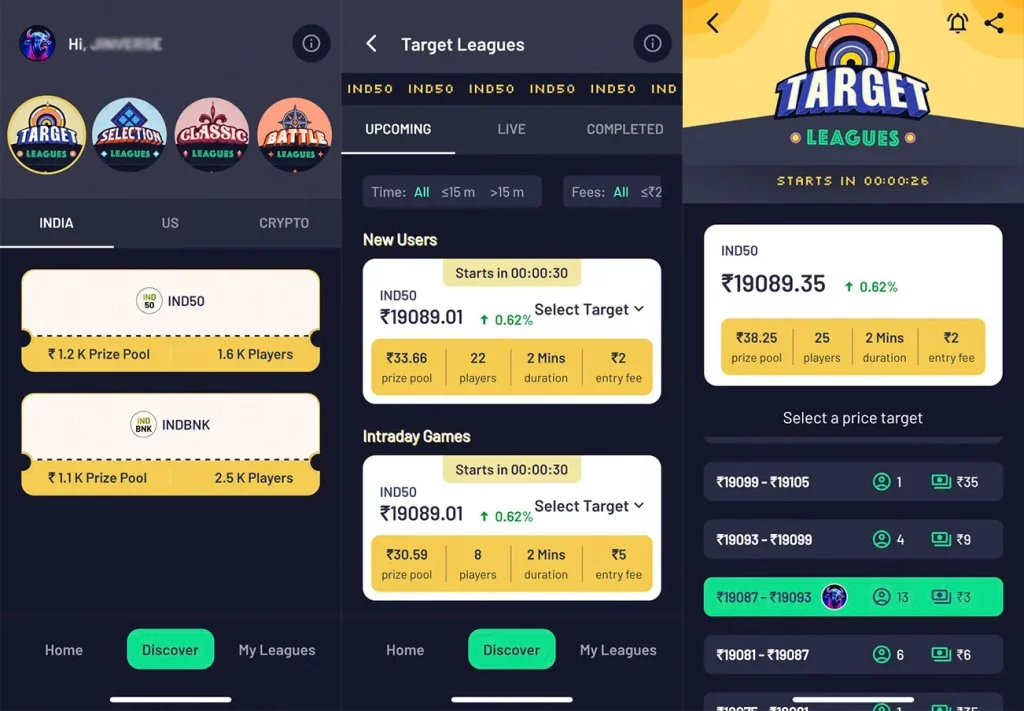

- Target Leagues – Play this league to set up price targets. Get the hang of forecasting price movements and, finally, practise technical analysis of stock performances.

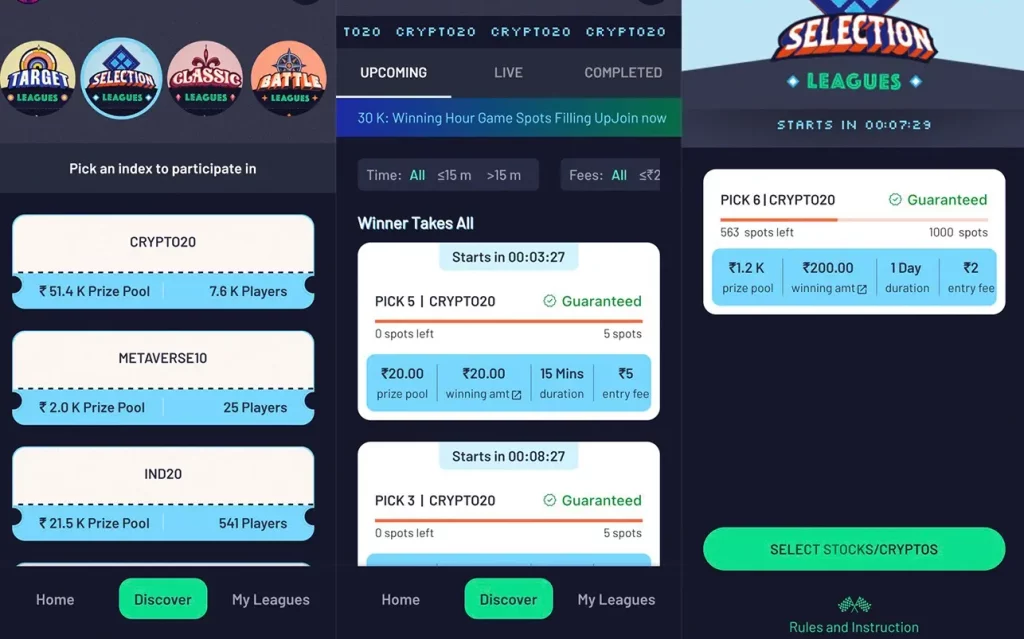

Selection Leagues – Develop your risk management skills by creating virtual stock portfolios. Practice on the league to build a well-varied portfolio. Gradually understand how to diversify the same.

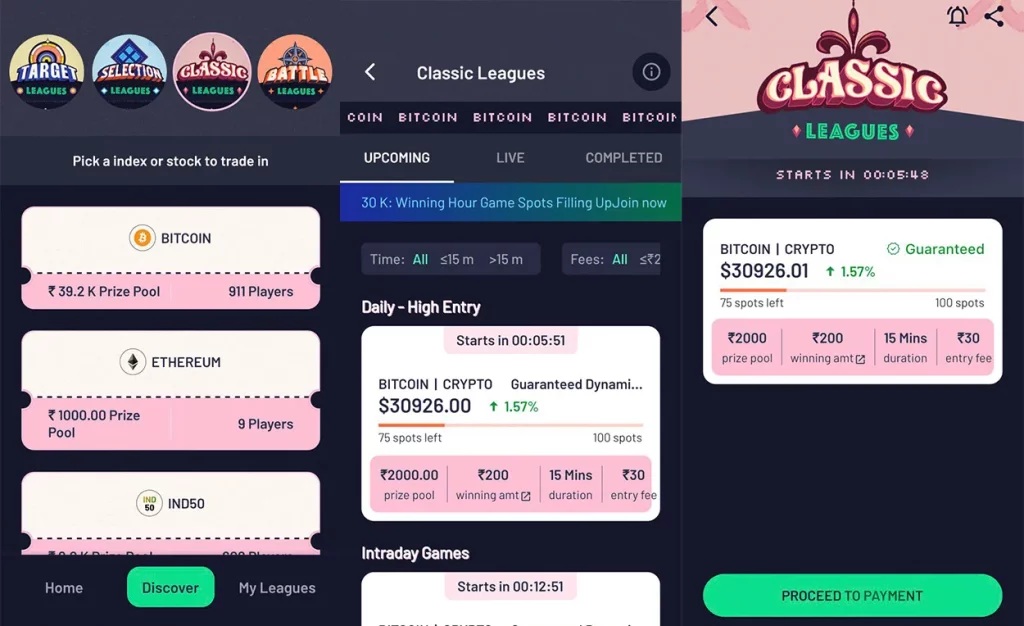

- Classic Leagues – Brush your intraday trading skills and develop an insight into technical chart analysis. Learn to time your trading correctly by playing Classic Leagues.

Conclusion

Just as Rome wasn’t built in a day, you cannot master intraday trading overnight. It takes research, patience, and close watching of stock performances. A stock market-based game such as TradingLeagues helps you practise how to handle stocks and track their pricing and performances at the same time. This helps you develop an idea about effective day trading quickly.

With its own watchlists and educative games, TradingLeagues helps beginners develop an understanding of intraday trade and stock markets. Download the app now. It is available for both iOS and Android.