Regardless of how much profit you have made on your preferred stock simulator practising buying and selling stocks in a simulated environment, trading in the real world is way different from mimicking the virtual stock market.

Although they are a decent platform to learn the basics of stock trading, stock market simulators have several drawbacks. There are multiple challenges that investors face when transitioning from simulated trading to real-time day trading of crypto and stocks with real money.

Among these are restrictive usage of simulated stock environment, unreal trades, lack of market psychology, overreliance on the model, and more.

Despite the various advantages of stock market simulators, traders must be aware of several downsides. For instance, one of the main limitations of stock simulators is their restrictive usage.

Likewise, all simulators have certain limitations regarding the number of stocks available, the level of complexity, and the types of orders you can place.

Some of the other pitfalls of paper trading or day trading simulators are listed below:

1. Trades are not realistic

One of the downsides of most stock trading simulators and virtual trading apps is that the trades here are not realistic, with no real-time trading environment and live prices.

This simply means that the prices received for opening and closing positions in a stock simulator may differ from those received in the real world.

Let us understand this better with an example:

Suppose there are only 200 shares of a particular stock offering at $5 available in the market.

But if the stock simulator or a virtual trader places an order for 2,000 shares in a stock simulator, they might get booked at the existing price of $5 for an entire lot of 5,000 shares of the virtual order despite only a certain percentage of the shares being actually offered at that price.

2. Lack of accuracy in transactions

Virtual trading apps or paper trading modes present another disadvantage – a lack of clarity on the impact on real money when users start using these platforms.. Besides, there can be more inaccuracies regarding platform fees or commissions that might not be clear.

For instance, it is important to remember that when you purchase cryptocurrency in the real world, it could cost approximately an additional $0.50 higher than paper trading.

These costs might multiply, but the virtual trading platforms or simulators fail to display the same with accuracy.

3. Ambiguity between the two trade and individual actions

Ambiguity between market trade and individual actions is a potential issue with stock trading simulators.. This requires investors to constantly watch market

correlation-related problems, which can be quite inconvenient for beginners.

For instance, since cryptocurrency tends to fluctuate due to its volatile nature, as a beginner investor, you might not be able to understand why such price movements occur when you engage in virtual trading.

4. Lack of adequate emotional connect

Investors may not experience the excitement of profit or the lows of real losses in stock market or paper trading simulators, as they don’t involve real money.

While this might help you make your investment decisions without stress, it also destroys the excitement of feeling high when you trade in real life.

5. Might push a trader into a false sense of complacency

While you can pull off an amazing or difficult trade in the virtual world, replicating the same in real life is not the same, and you can lose big time.

These things require great precision and many years of experience to know the appropriate place to put your money. Simulators don’t train you for such risky strategies and dangerous trading habits.

6. Manipulating trading psychology

Not taking investor psychology into account is another major drawback of stock simulators. This is mainly because actual or real hard cash is not at risk here.

Although it is easy to follow the trading principle of cutting losses and letting winners run in simulated trading, it is not the same in the real world, where investors stick to a losing position, hoping that it will eventually come back to break even or a profit as it is psychologically difficult to accept a loss.

Reasons to try out stock market games in 2024

stock market games provide an excellent alternative to paper trading apps. They offer the opportunity to engage in simulated games, refining stock/crypto trading skills without the limitations of paper trading on other apps.

Here are some of the key reasons to try out stock market games on TradingLeagues in 2024:

- It is an excellent way to gain practice and experience in trading

- Fun and engaging games

- Helps you build your confidence and skills before you start trading with real money

- Teaches you valuable lessons about risk management, asset classes, and investment strategies.

Play ClassicLeagues on TradingLeagues for real-time, accurate day trading to practice their skills

If you are new to the stock market and are clueless about where to start, TradingLeagues offers an excellent platform to learn the tricks of stock trading while playing games. It is an excellent solution for covering the limitations of stock trade simulators.

By simply joining the TradingLeagues app and playing the top games on the platform- Classic Leagues, Battle Leagues, Selection Leagues, and Target Leagues- you can learn the basics of trading in the stock and cryptocurrency market.

Let’s find out how.

1. Classic Leagues

Classic Leagues is one of the most popular games on the app that allows players to compete with each other as they engage in day trading. The best part of this league is that it allows you to learn more about investing while also competing in an environment that is completely skills-based.

You can also check the Leaderboard here, which showcases the complete list of participants with their avatars and winning positions.

The key highlight of Classic League that distinguishes it from other paper trading apps is that the platform offers real-time charts for tracking price movements. Apart from this, you can also use the app to find the best time for purchasing/selling, giving you options for applying basic technical indicators.

Besides, you can also use the app to employ various strategies as you play the different games across the four leagues. Among these are-

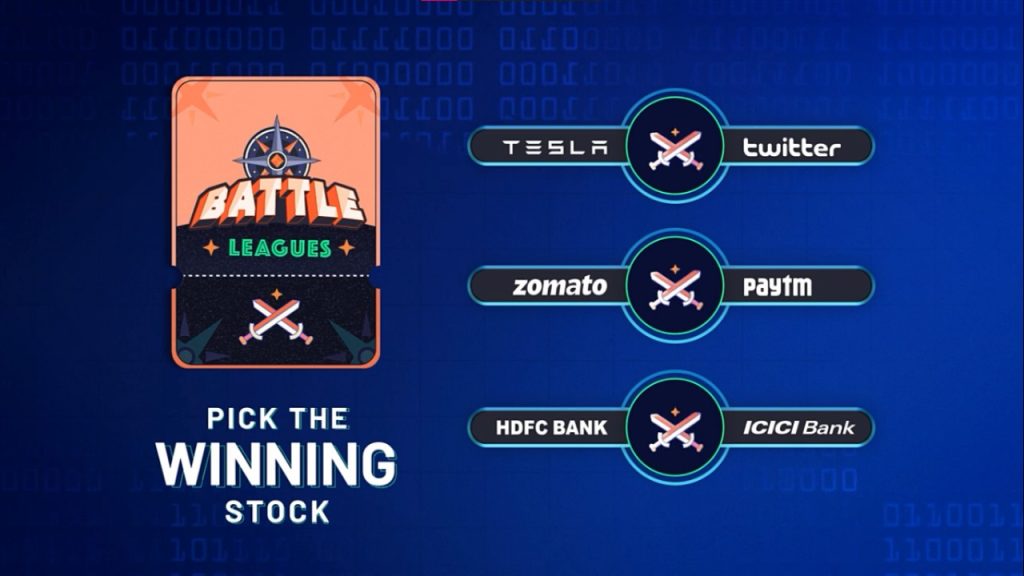

2. Battle Leagues

While playing battle leagues, players can learn various ways to compare stock prices and accordingly pick the best ones that suit their investment objectives.

3. Target Leagues

As the name suggests, Target leagues are games designed to help you learn how to analyse price charts and use various technical indicators to maximise profits.

4. Selection Leagues

Selection leagues are another set of interesting games that help you practice ways to diversify your portfolio as per your respective investment objectives and risk appetite.

In Conclusion

While stock simulators are useful for practising trading in a real-world-like environment without risking actual capital, the mentioned downsides highlight their limitations.

Playing fantasy stock market games such as TradingLeagues is a great alternative as they helps you understand how the market works. You can also use the app to enhance your skills for execution by testing various strategies across the games. The highlight of the app is that it lets you practice well before transitioning toward stock or cryptocurrency trading. To know more, explore TradingLeagues now.