- The Digital Asset Anti-Money Laundering Act, proposed by Senator Elizabeth Warren, has gained significant support in the Senate and is likely to move forward.

- The bill has set its sights on financial risks related to cryptocurrencies, such as money laundering, sanction evasions, etc.

- Key provisions aim to extend the responsibilities under the Bank Secrecy Act in such a way as to include digital asset entities and aims to address unhosted digital wallets.

What is the Digital Asset Anti-Money Laundering Act?

The world of digital finance evolves rapidly, and new technologies often outpace regulatory frameworks that are already in place. This is where the Digital Asset Anti-Money Laundering Act comes into play. The Act is a proposed legislative stride aiming to bridge this regulatory gap when it comes to cryptocurrencies and digital assets. Let’s dive into the key provisions of this proposed legislation, designed to tighten the reins on financial crimes and bolster transparency in the digital asset realm. Here are some key points that Elizabeth Warren’s proposed legislation will target:

Expanded Regulation

The Act aims to expand the scope of financial regulation to include digital assets and cryptocurrencies.

Definition of Financial Institutions

The Act also seeks to categorize crypto exchanges, wallets, and other crypto service providers as financial institutions.

Reporting Requirements

It proposes imposing reporting requirements on these entities for transactions exceeding certain thresholds, ensuring better transparency and tracking of large cryptocurrency movements.

Enforcement and Penalties

The Act intends to strengthen enforcement mechanisms and penalties for non-compliance with regulations within the digital asset space.

Coordination among Agencies

It aims to promote coordination among various federal agencies, such as the Treasury Department, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC), to establish a unified framework for regulating digital assets.

Consumer Protection

The legislation emphasises protecting consumers and investors by addressing potential risks and vulnerabilities associated with cryptocurrencies.

Consequences of the Digital Asset Anti-Money Laundering Act

Should the Act become enforced as law, this could lead to a dramatic increase in the regulatory compliances that are enacted upon the realm of digital finance. Therefore, it is possible that the Act could have consequences on multiple frontiers. Some of the possible implications of the Act are as follows:

Tighter Regulatory Oversight

The act would subject the cryptocurrency industry to more stringent regulations, treating digital assets and related transactions with the same scrutiny as traditional financial activities.

Increased Compliance Burden

Businesses dealing with cryptocurrencies, including exchanges, wallets, and other service providers, would face heightened compliance requirements.

Impact on Innovation

Critics argue that overly stringent regulations could stifle innovation within the cryptocurrency industry.

Impact on Privacy and Anonymity

The focus on regulating “unhosted” digital wallets and tracking transactions through various technologies like mixers could impact the privacy and anonymity features that some cryptocurrencies offer.

International Implications

Extending Bank Secrecy Act (BSA) rules to cover foreign bank account reporting involving digital assets could have international implications. It might prompt other countries to consider similar measures.

Compliance Challenges

Implementing the regulations outlined in the act might pose significant challenges for both businesses and regulatory bodies.

Market Response and Adaptation

The enactment of such legislation could prompt shifts in the cryptocurrency market. Some businesses might adapt and thrive under the new regulatory framework, while others may struggle or exit the market due to compliance complexities and costs.

Criticisms of Elizabeth Warren’s Crypto Bill

The Bill is not free of faults, and various criticisms and concerns have been voiced on different platforms. The voice of the public is a valid indicator of the shortcomings that might occur if the bill is not given proper consideration.

Here are some of the top points of criticism that are faced by Elizabeth Warren’s proposed legislation:

Overreach on Personal Freedom and Privacy

The bill is criticised for its perceived intrusion on the personal freedom and privacy of cryptocurrency users and developers. It mandates extensive personal information collection, AML programs, and reporting without due legal process, potentially infringing on individual liberties.

Impact on Innovation and Decentralization

Critics argue that the bill imposes strict regulations that hinder innovation within the cryptocurrency industry. By requiring developers and node operators to register and survey their infrastructure, it could undermine the very essence of permissionless and decentralised blockchain networks, limiting technological progress.

Constitutional and Rights Concerns

The legislation is scrutinised for potential constitutional violations, including First and Fourth Amendment rights. It’s viewed as potentially unconstitutional in compelling speech, imposing prior restraints on expression, and coercing the collection and reporting of private information without due process or relevance to business purposes.

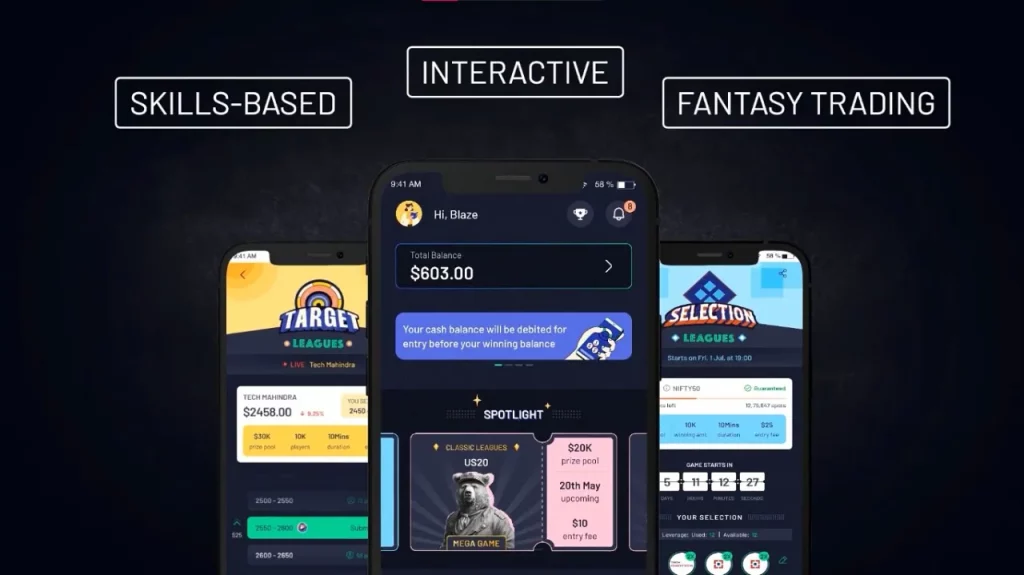

You might not be someone who wants their privacy trifled with. You might just be looking to start your trading career in a stress-free, yet competitive environment. If you are worried about how these regulations may affect the market, then fantasy trading is exactly where you need to be. Switch to TradingLeagues to get your stocks on. Learn and teach yourself of the ways of the market, minus the stress.

TradingLeagues: The best fantasy crypto & stock market trading game for practising day trading

Introducing TradingLeagues, the best fantasy trading game out there! An edge above the competition, TradingLeagues is well-equipped with the latest updates in both stock and crypto to ensure that you get the best place to practise, improve and compete with your day trading skills! Check out how our different modes can teach you to become a better stock & crypto trader.

Classic Leagues

This mode simulates trading activity, allowing players to engage in competitive play based on market movements. Participants navigate a simulated market environment, making strategic trading decisions to outperform others. With varied winning distribution models available, this mode encourages competitive yet strategic trading within a simulated market landscape.

Target Leagues

Players immerse themselves in a competition centred on forecasting the ultimate traded value of chosen stocks. Emphasising precise predictions, this mode challenges players to accurately gauge stock prices by the league’s conclusion. It provides a platform for testing one’s capacity to forecast stock movements within a competitive environment.

Selection Leagues

The emphasis shifts towards constructing winning portfolios based on stock performance. Players strategize to curate portfolios that deliver optimal performance throughout the league duration. This mode challenges participants to make calculated choices in selecting stocks, offering diverse winning distribution formats and fostering an environment that rewards strategic decision-making.

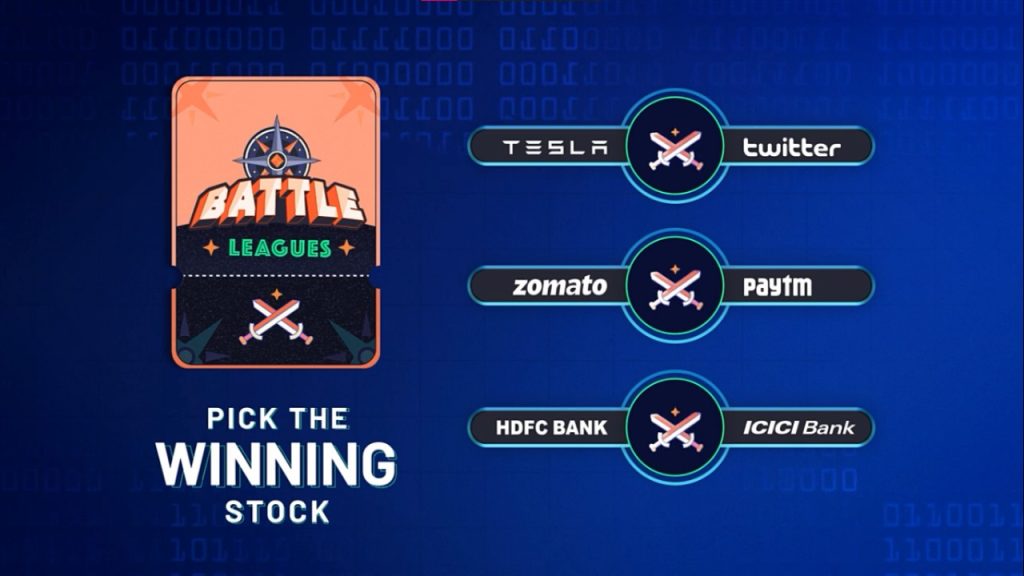

Battle Leagues

This mode differs by focusing on educating players about effectively comparing and selecting stocks. Rather than direct competition, this mode serves as a learning platform, aiming to equip participants with skills in evaluating and choosing stocks that align with their investment objectives. It offers an educational experience to enhance players’ stock selection abilities.

Conclusion

The Digital Asset Anti-Money Laundering Act, proposed by Senator Elizabeth Warren, seeks to close the regulatory gap in the swiftly evolving realm of digital finance. Designed to improve defences against financial crimes and also to enhance transparency, this legislation targets key aspects within the cryptocurrency and digital asset landscape. However, its potential ramifications span multiple fronts, presenting both opportunities and challenges.

Rock out with TradingLeagues on our various gaming modes to improve your skills in day-trading, portfolio management, crypto trading, etc and earn high rewards in the process. Compete with other fantasy trading enthusiasts and find out how you stack up against them! Earn cash rewards and trade your hearts out!