Cryptocurrency has currently turned into a much more mainstream investment choice now. The trends and performances in the crypto market help traders understand how the currency behaves and how the market works before making investments in crypto.

When you buy and sell crypto coins to make profits, you are trading in the same. Trading strategy forms the backbone of trading and every trader adopts a different strategy. This helps set up rules that facilitate trading in the crypto marketplaces.

- The crypto trading domain is riskier when compared to the traditional investment markets because it is decentralised.

- You need to develop skills to trade in crypto since it is relatively new as an investment marketplace.

- There is no one set strategy that applies to crypto traders. Depending on your trading goals and trading style, you can adopt one or a mix of several crypto trading strategies.

- You can ensure to minimise losses by setting up a risk management technique. As a beginner, this safeguards your money and helps you gain profits on crypto trading.

Take a look at the top cryptocurrency trading strategies that could help you trade in the market. Adopting these helps you control the financial risks of crypto trading. It also helps prevent losses from impulsive investments without an idea of how crypto trading works.

Crypto day trading strategies in 2023 for beginners

When you are a beginner in trading crypto, the right strategy to choose will depend on your risk tolerance. The expert advice in this context is to adopt a small and passive strategy. However, you could engage in active trading if you manage to pick a strategy that supports the same.

1. Technical Analysis

Technical Analysis is a beginner-friendly strategy and involves the studying of financial data. This comprises historical prices as well as data points. Analysing the chart patterns will help you locate the statistical trends in crypto markets and manage the risk as a beginner. Naturally, you get to identify opportunities that can help you trade for earning profits.

Why does this strategy work for beginners?

- The strategy applies to any market and security based on historical data for trading. Beginners find it reliable to make decisions based on such data.

- This strategy helps assess how past crypto performance could affect profits or losses.

2. Range Trading

Range trading is based on targeting the non-trending (sideways) markets by means of identifying the high and low-priced coins when stable. As a beginner, it helps to find such information from charts under the support and resistance level hearers.

As a beginner, you can use a range trading strategy to find the right time to purchase any crypto asset at a low price. You can also figure out the right time for selling the same for a higher price.

Why does this range trading strategy work for beginners?

- Strategy reveals well-defined points for entry and exit

- This strategy helps minimise losses

- The strategy ensures smaller profit margins across a span

3. Long straddle

The strategy for long straddle in day trading with crypto targets making a profit from the volatility of markets. With this strategy, you purchase a call and a put contract for a single cryptocurrency. That is, you make the purchase with the same expiry date and strike price.

In a long straddle, it’s expected that while one side of the trade may result in losses, the profit gained from the winning position will outweigh those losses, leading to an overall net gain.

Why does this long straddle strategy work for beginners?

- Strategy is suitable for beginner traders who get to make an overall profit even if there is a loss for one side of the trade.

4. Breakout strategy

With this strategy, you will be on the lookout to enter any trade once the price of a coin breaks out to a specific level. As a beginner employing this strategy, you need to aim to bank upon the acceleration in the direction of such movement. The price breakout might occur in both the upward or the downward directions.

Why does this strategy work for beginners?

- Strategy is easier to understand since breakouts could occur from trend reversal, continuation patterns, and moving average changes.

5. Arbitrage

With the arbitrage strategy, you buy a coin on an exchange to later sell it on another exchange for a profit. This lets you take advantage of price variations in a specific coin on two separate exchanges.

Why does this arbitrage strategy work for beginners?

- The arbitrage strategy works since this market is not completely unregulated because a number of exchanges often have ample price differences.

Conclusion

Once you judge your goals from crypto trading and risk appetite, you can pick one or a mix of strategies for the same. The best strategy for crypto trading is one that is suitable for the financial goals you have.

There is some risk associated with crypto trading, as with just about any investment. However, if you have access to an app that allows you to season your trading skills via games, you can actually become an informed crypto trader.

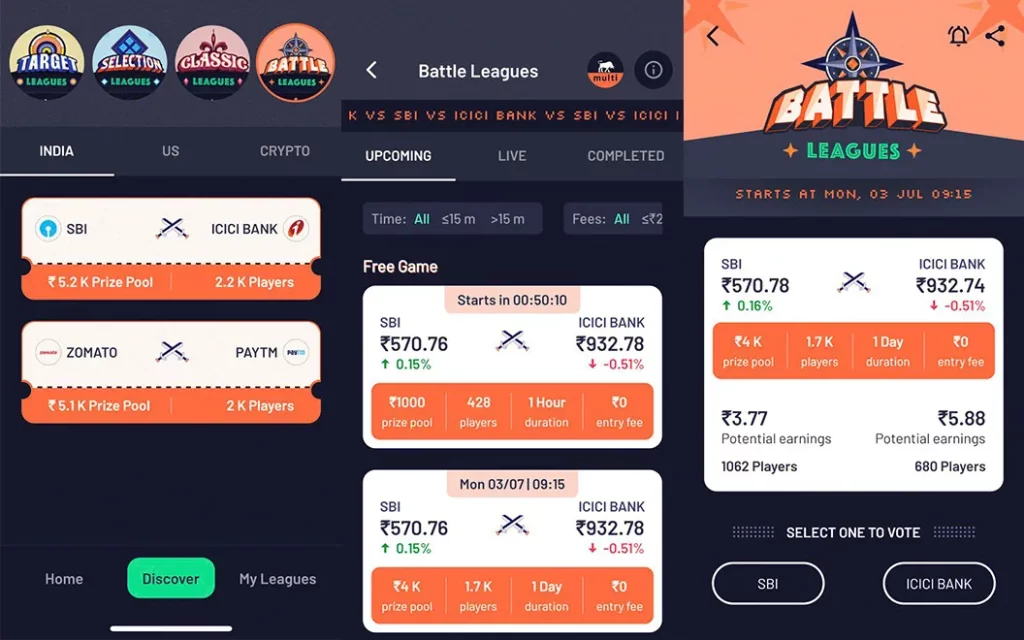

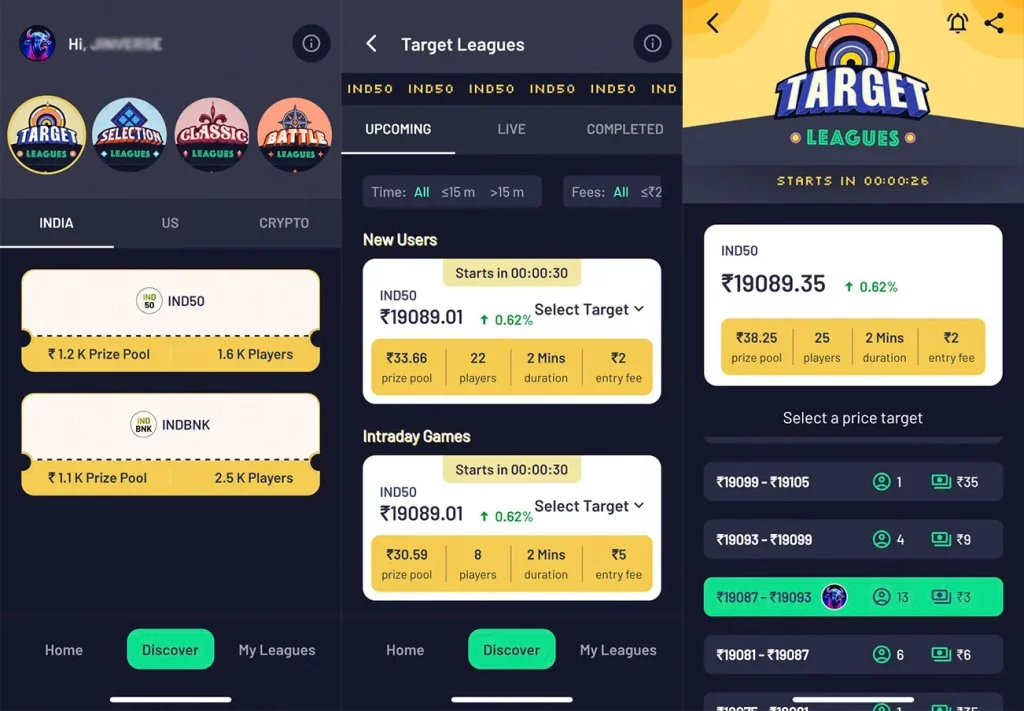

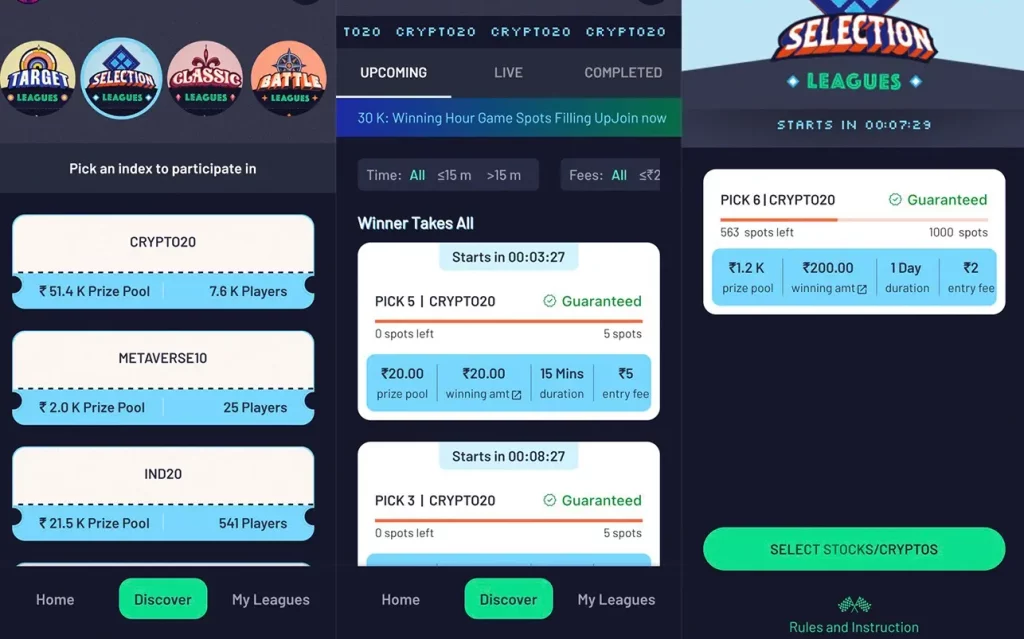

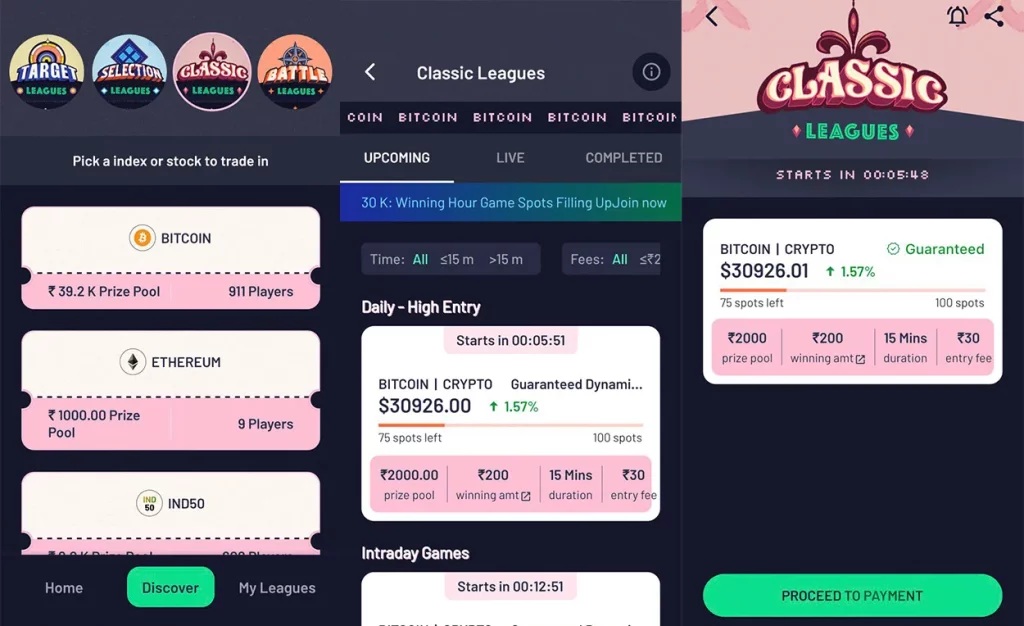

TradingLeagues, the fantasy crypto & stock market trading game app available offers simulated trading experience! Spread over four leagues; several games help you practise what it is like to trade in cryptocurrency. The multiplayer fantasy crypto trading games help to understand what crypto coins other players are betting on. Take a detailed look at the four leagues below-

Battle Leagues

Simply pick one of two crypto coins and vote for the one you think will outperform the other. Relax and have fun as you learn which coin to place your stakes on!

Target Leagues

Brush your forecasting skills and predict the price for the crypto coin to win big. Polishing your forecasting skills will help you understand how price movements occur in the cryptocurrency world.

Selection Leagues

Create a fantasy crypto portfolio by adding the best performing crypto coins. You can actually learn to add the coins that are priced better than others. Of course, you also get to learn how the crypto market works!

Classic Leagues

Trade without stress and experience simulated day trading. Brush your day trading skills in the crypto market and win big!

Sign up to TradingLeagues to polish your crypto trading skills and gain the right knowledge even as a beginner.