The cryptocurrency market is well known for its volatile nature. This means that the cryptos can lead to rapid price gains or can quickly drop up to more than 50% within a short period.

For example, following a sudden price spike in November 2021, cryptocurrency prices experienced a crash in the subsequent year.

Similarly, 2023 commenced on a positive note for the majority of cryptocurrencies, with many tokens displaying improved performance. However, the prices are still low compared to their all-time highs.

This kind of price fluctuation acts as a reminder for investors to remain prepared all the time, as prices can go down quickly and can lead to a crypto market crash.

While the crypto market started on a strong note in 2023, with Bitcoin gaining over 50% of its value within the first quarter, the following quarter did not witness a similar sort of growth.

With high volatility and high market unpredictability, the market saw many cryptocurrencies fluctuate and crypto crash in 2023.

Here we will discuss the top crypto crashes in 2023 that you should know about:

1. TerraLuna Classic

Value at the beginning of the year: $0.000204

Value after the crash: Came down to $0.000086 or 57%, and it continues declining.

Reasons behind the crash

- Massive crash of the Terra Luna in May 2022

- Internal disputes between the members of the LUNA community who could not agree on a new pegging policy

- Massive selling of holdings of LUNC by key members triggered a huge sellout for the token

2. ApeCoin

Value at the beginning of the year: Price increase from $3.6 to $6.3

Value after the crash: The free fall of ApeCoin started at the end of H1 when the price reached $2.2 (a drop of 65%).

Reasons behind the crash

- Crypto market crash in 2022

- Declining prices of NFTs

- Community dispute that led one investor to liquidate and sell their NFTs and caused falling prices

3. PanCakeSwap

Value at the beginning of the year: $3

Value after the crash: $1.3 in July 2023 (even with a slight recovery in February up to $4); the price eventually started declining

Reasons behind the crash

- Token overselling

- Multiple staking campaigns gone wrong

- Staking campaigns launched by the token led to user dissatisfaction due to the long lock-up period

4. Sandbox

Value at the beginning of the year– $0.89

Value after the crash: Price plummeted to $0.41 by the end of the 1st half of the year

Reasons behind the crash

- 2022 cryptocurrency crash

- SEC's announcement to de-regulate some tokens worried investors about the future price

- Exchanges delisting tokens from the platforms led to free fall

- Token overselling

5. Kadena

Value at the beginning of the year: $1.35

Value after the crash: $0.59 in July, and it kept declining.

Reasons behind the crash

- Impact of the 2022 Crypto Crash

- Less to no buyer interest

- Token overselling

Key reasons behind the crypto market crash

There are several reasons that could lead to such crypto market crashes. Some of these are listed below-

Liquidity troubles

Few crypto exchanges have experienced liquidity issues in the recent past. They may be one of the reasons that have contributed to the market downturn.

Apart from this, technical factors such as market conditions or changes in trading patterns may also contribute to the market downturn.

Cryptocurrency volatility

Since the crypto market is highly speculative, investors sometimes become too optimistic about the future of cryptocurrencies.

There are crypto influencers who drive this kind of volatility, leading to a bubble that eventually leads to a market crash.

Security breaches

Security breaches, followed by regulatory actions by governments and other financial institutions, can also impact the crypto market significantly.

For instance, concerns in 2022 about security reaches and increased regulation of cryptocurrencies may also contribute to the market downturn and crashes.

Market correction after rapid growth

Whenever the crypto market experiences rapid growth in the preceding months, it is believed that a correction is due after such a rapid run-up.

Besides, concerns about the scalability of cryptocurrencies may also contribute to the market downturn.

Negative news events

Any kind of negative news events, such as scams, hacks, and market manipulations, can have a significant impact on crypto market sentiments. This can drive down prices and lead to cryptocurrency crashes

While several other reasons can lead to a crypto crash, if you have decided to take serious steps to become a crypto day trader, you are on the right track.

There are strong and optimistic predictions about the 2024 crypto market and the best crypto to invest in after the crash. To navigate such volatile markets and crypto crashes better, apps like TradingLeagues can help you significantly to learn and earn simultaneously.

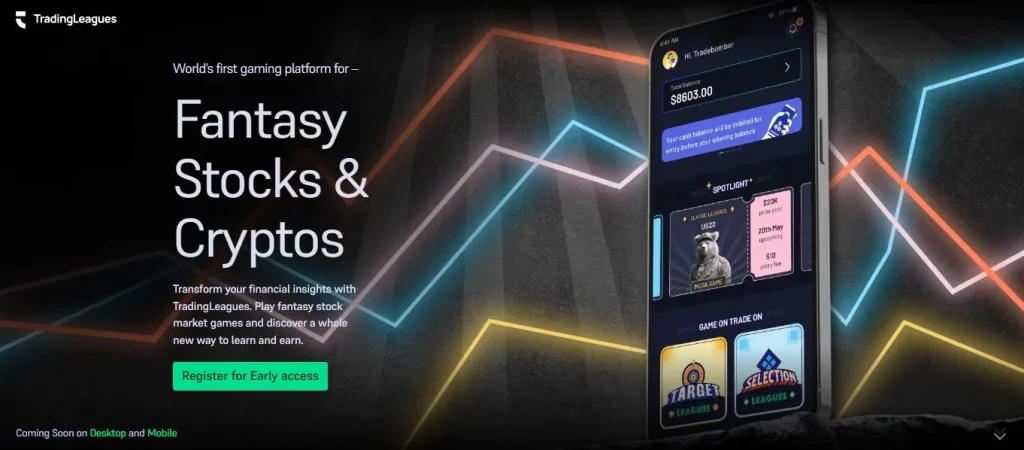

Enjoy your crypto trading with the best fantasy crypto trading game: TradingLeagues

If you are new to the crypto market and looking to learn more about cryptocurrency trading, sign up with TradingLeagues. The fantasy crypto trading game allows you to play exciting fantasy trading games and discover a whole new way to learn and earn.

The key highlights of TradingLeagues are:

Knowledge through exciting gameplay

The best part of the app is that it allows you to learn with every contest in this virtual trading game. You can simply immerse yourself in the world’s finest markets and enhance your skills.

Earn while you play

Apart from learning new trading skills, you can also earn while you play the most exciting crypto games on the platform.

24×7 non-stop entertainment

With TradingLeagues, you can enjoy over 100 daily trading games to indulge in crypto trading. Whether you’re interested in cryptocurrencies such as Bitcoin or Ethereum, FX, or global stocks, there will always be a game for you.

To Conclude

Cryptocurrency crashes are a key concern for crypto investors. However, it is important to keep in mind that the crypto market is extremely volatile and prone to either drop in value or sudden market crashes.

There could be multiple factors that can cause a crash, including the popularity of a currency, market manipulation, or increased interest in a particular cryptocurrency.

As an investor, the best way to safeguard yourself from these crypto crashes is by:

- Diversifying your portfolio

- Investing in less volatile cryptocurrencies

- Thoroughly researching strategies that help make the most of the current market conditions

Looking forward, the predictions are quite optimistic about 2024, after an eventful 2022 and an exciting 2023 with several developments in Web3 projects and DeFi platforms.

The need here for investors is to make informed decisions to keep a close watch on another crypto crash coming.

So if you are new to cryptocurrencies and looking to learn the tricks of the trade, what are you waiting for?

Sign up with TradingLeagues today! The platform helps you to master crypto trading through a variety of interesting games and enjoy massive profits later.